On Friday, August 22, Forbes reported that the wealth of 20-time “Grand Slam” champion Roger Federer had reached an estimated $1.1 billion — a figure stated before taxes and agent commissions. For a player renowned not only for record-setting consistency on court but also for an impeccable personal brand, this milestone is the logical result of a long-term, well-planned commercial strategy.

A Billion From Media Deals and Commercial Ventures

The bulk of the Swiss star’s income has come from endorsement contracts, exhibition appearances, and other commercial projects. It was away from the court—through long-term partnerships and targeted deals—that Federer converted sporting success into a large-scale financial outcome.

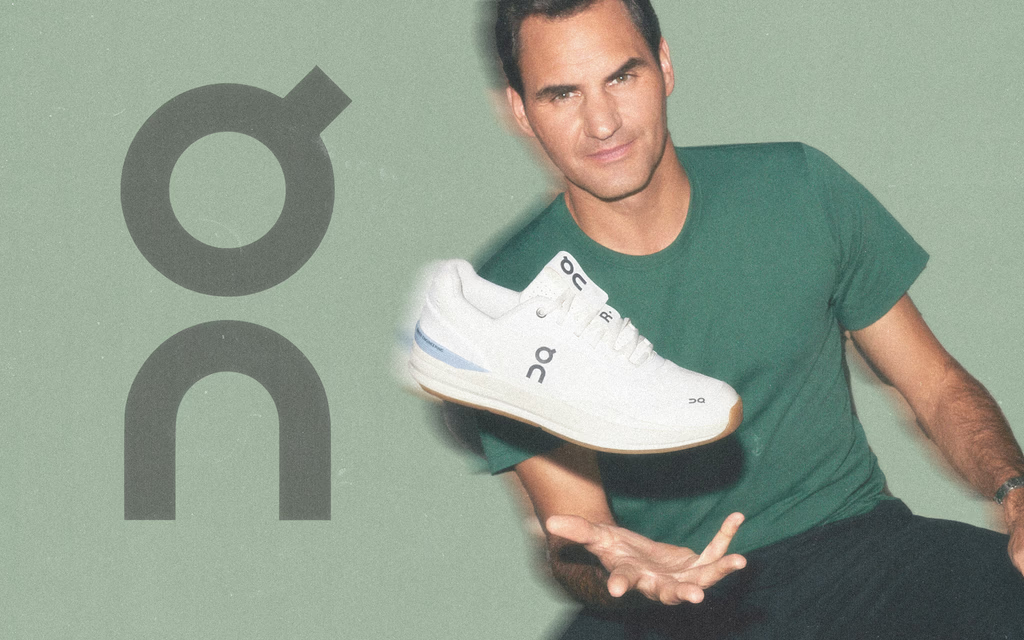

Key Asset: The Bet on On

A substantial portion of his wealth is tied to a stake in the Swiss sportswear and footwear company On. According to Forbes, that holding exceeds $375 million. An investment made as the brand surged in popularity has become a strategic, high-return asset for Roger.

Diversifying Capital

Beyond On, the tennis player has invested over the years in a range of ventures: the private-jet operator NetJets, premium eyewear brand Oliver Peoples, and UBS bank. Such a portfolio reduces risk and strengthens the long-term resilience of his finances.

The Select Seven: Who's on the Same Tier

By reaching the billion mark in career earnings (before taxes), Federer joined a short list of sports icons: LeBron James; golfers Tiger Woods and Phil Mickelson; footballers Cristiano Ronaldo and Lionel Messi; and boxer Floyd Mayweather. For the tennis world, this is a vivid example of how Grand Slam titles and savvy brand management can be converted into capital on a global scale.